Irs Estimated Tax Payment 2025 Form - Payment 20202025 Form Fill Out and Sign Printable PDF Template, How to make estimated tax payments and due dates in 2025. You can also make a guest payment without logging in. 20222025 Form OK OW8ESSUP Fill Online, Printable, Fillable, Blank, Send the income tax vouchers to the address. Go to your account sign in to make a tax deposit payment or schedule estimated payments with the electronic federal tax.

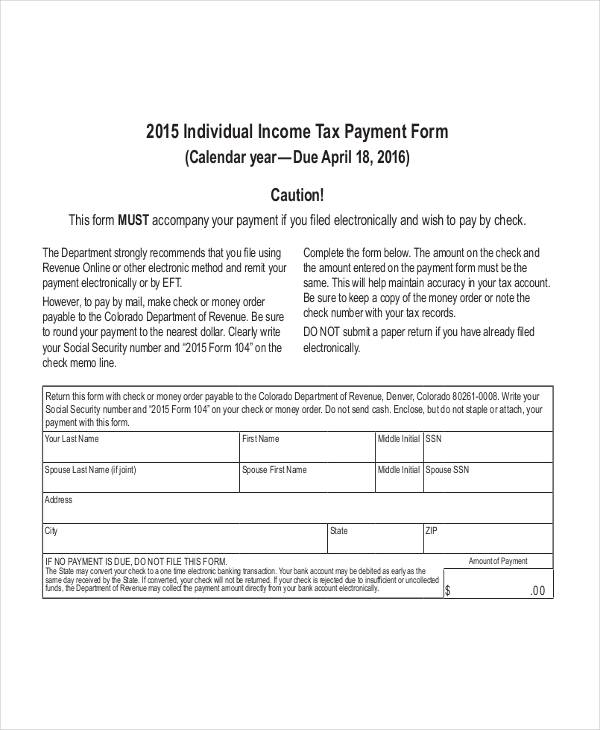

Payment 20202025 Form Fill Out and Sign Printable PDF Template, How to make estimated tax payments and due dates in 2025. You can also make a guest payment without logging in.

Estimated Tax Payments 2025 Form Berna Cecilia, Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you've earned that wasn't subject to tax withholding. Final payment due in january 2025.

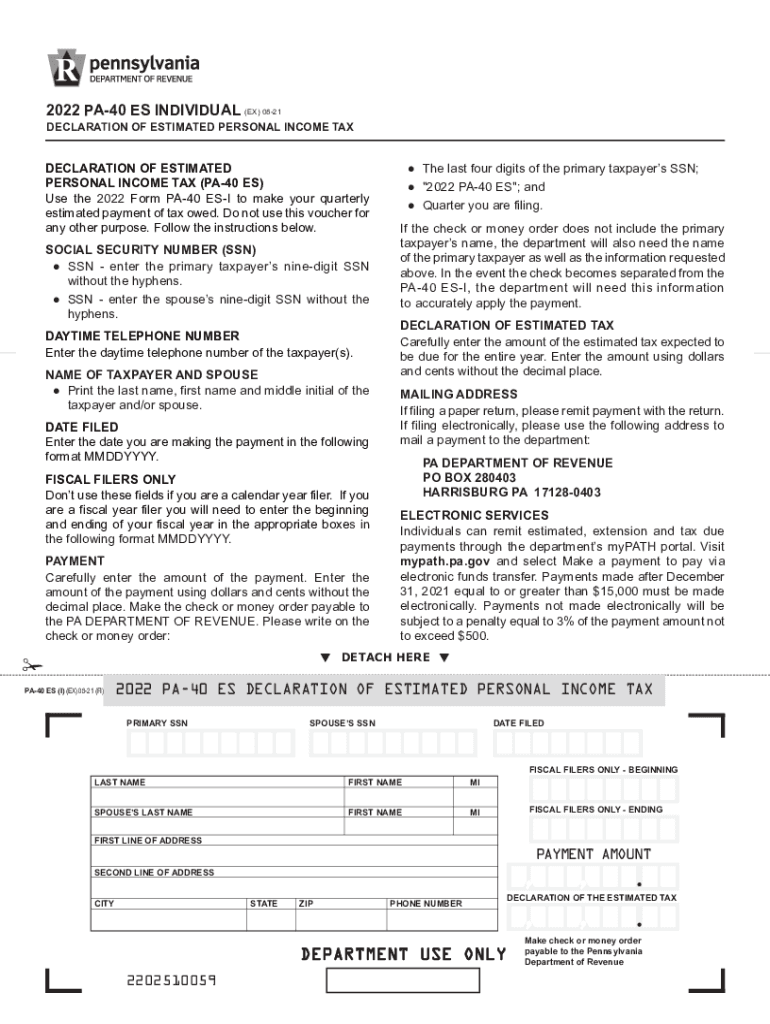

Pa 40 Es 20222025 Form Fill Out and Sign Printable PDF Template, If you expect to owe at least $1,000 in taxes, after all deductions and credits, and your withholding and credits are expected to be less than the calculated. Make payments from your bank account for your balance, payment plan, estimated tax, or other types of payments.

There are four payment due dates in 2025 for estimated tax payments:

Estimated tax payments are the taxes you pay to the irs throughout the year to account for income you’ve earned that wasn’t subject to tax withholding.

There are four payment due dates in 2025 for estimated tax payments:

Irs Estimated Tax Payment Due Dates 2025 Tove Oralie, View 5 years of payment history, including. When figuring your 2025 estimated tax, it may be helpful to use your income, deductions, and credits for 2025 as a starting point.

Sc Estimated Tax Payments 2025 Raf Leilah, Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your. You can make estimated tax.

Federal Estimated Tax Forms 2025 Melli Siouxie, When are business estimated tax payments due in 2025? The irs is reminding taxpayers who need to make estimated tax payments that the 2025 second quarter estimated tax deadline is june 17.

Fillable form 1120 Fill out & sign online DocHub, By the end, you’ll feel more equipped to navigate estimated. Alternatives to mailing your estimated tax payments to the irs;

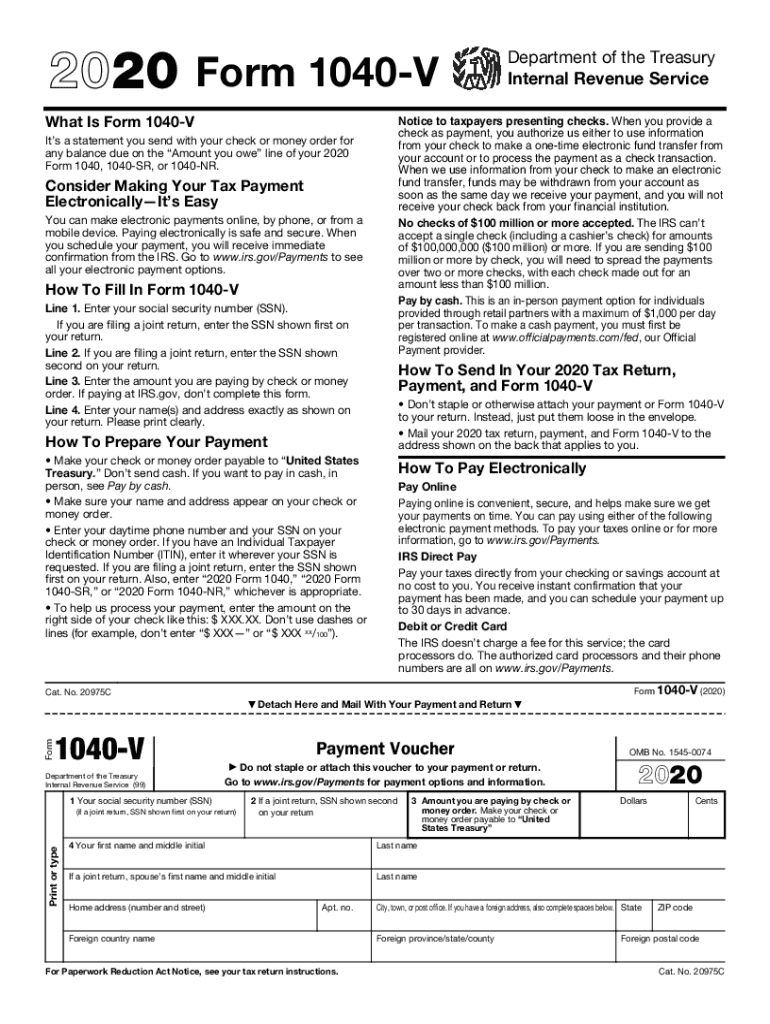

2020 irs 1040 form Fill out & sign online DocHub, Estimated taxes are due each quarter of the year, with each payment having a specific due date, with the june 17 deadline being for the second quarter of 2025. 2025 estimated tax payment vouchers, instructions & worksheets.

Federal Estimated Tax Payments 2025 Form Bibi Marita, The 8% rate went into effect in late 2025 and is the highest since early 2007. Alternatives to mailing your estimated tax payments to the irs;

If you expect to owe at least $1,000 in taxes, after all deductions and credits, and your withholding and credits are expected to be less than the calculated. Make a payment from your bank account or by debit/credit card.

Irs Estimated Tax Payment 2025 Form. Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your. Direct pay with bank account.